ROA | Return on Assets

Return on Assets, or ROA for short, is characterized in the market as the yield on assets because it represents a company’s ability to generate profits from the assets it owns.

What is ROA – Return on Assets?

ROA (return on assets), along with a number of basic metrics such as ROI, ROE, ROCE, and others, is a metric that serves as a basis for investors to quantify the value generated by a company. This metric gives an entrepreneur, investor or analyst an idea of how efficient a company’s management is in generating returns for its shareholders. In general, this indicator tells what profits (annual surplus) a company has generated from the total capital invested.

How exactly does the profitability calculation work?

The return on assets metric, expressed as a percentage, gives investors an idea of how effective the company is at converting assets into cash values. So the higher the metric, the better for the investor in this area. If a company has a low return on assets, it could be due to a number of reasons, such as investing in unprofitable projects; low asset productivity; or very high expenses and overhead.

For a company to improve its profitability indicators, management must constantly re-evaluate its business to improve the allocation of its resources. If this attitude is not adopted, especially in companies in highly competitive sectors such as insurance, it is very likely that these companies will allow their earnings to “erode” until they suffer bitter losses.

How to calculate the ROA?

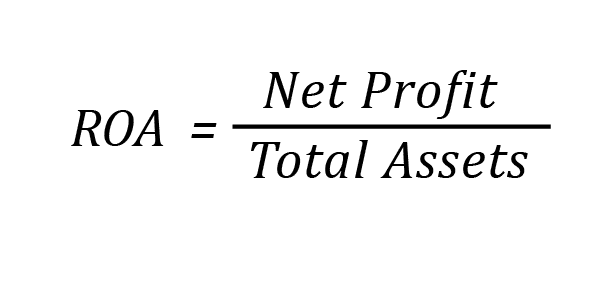

The calculation of the return on investment is given in the following formula:

ROA formula

Calculate ROA

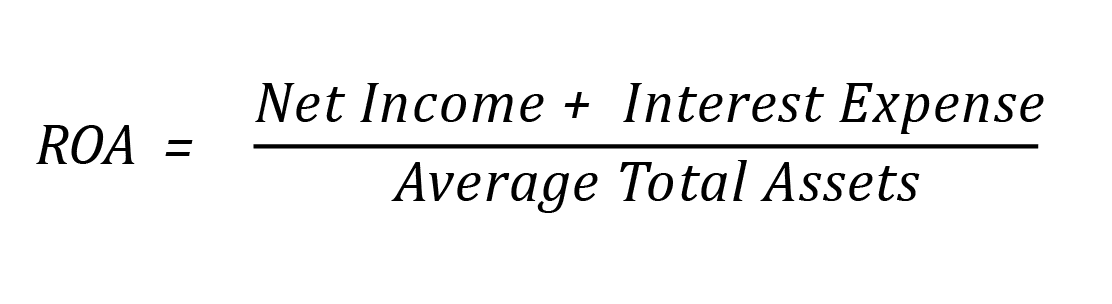

It is very important to point out that when talking about total assets/total capital in a balance sheet, one is talking about the accounts in which the assets, loans and rights that make up the assets of the company are shown added to its total liabilities. Because a company’s assets are financed by debt or equity, some analysts disregard the cost of acquiring the asset and add back the interest expense in the ROA formula. So the formula for calculating this metric for this analyst would be:

Advantages (and caution) of ROA analysis

There are a number of obvious benefits if an investor wants to track this profitability metric in a company:

- They assess management’s ability to allocate capital;

- They measure the efficiency of assets;

- Establish parameters to control costs and expenses;

- Comparison of the profitability of the company compared to similar companies.

Despite many advantages, it is important to emphasize that analysis performed using only metrics is far from ideal. This is due to the investor’s need to understand how the company generates revenue and what management plans are in place for the future.

Moreover, many companies that generate high returns today may not be in a similarly advantageous profit situation in some years. The true value of a company, on the other hand, is based on its competitive advantages, whether through strong brands, for example, or through the company’s ability to sell its products or services at low prices.

Conclusion: ROA is an important metric for measuring the profitability of a company

ROA (Return on Assets) is a profitability index. It is an indicator that shows how profitable a company is in relation to its total assets. This ratio provides information on how efficiently a company’s management uses its assets to generate profits. Return on assets can be a useful indicator to compare the company’s performance from one year to the next. It can also be used to compare the performance of two different companies.

In this case, however, a deeper understanding of the nature of the business is required, as some industries and companies require larger amounts of fixed assets to produce goods and services for sale.